update on unemployment tax refund today

Wow Fourth Stimulus Check Update 1000 Unemployment Stimulus Check Ir Tax Refund Good News Irs Taxes Irs Unemployment Tax Refund In 2022 Tax Refund Unemployment Irs. The current maximum individual tax rate in New York is 882 percent.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment.

. The page youre trying to find is now located here. Check For the Latest Updates and Resources Throughout The Tax Season. Ad File your unemployment tax return free.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. 22 2022 Published 742 am. Watch popular content from the following creators.

Free File your return. Weve changed our website domain to taxnygov. In the latest batch of refunds announced in November however the average was 1189.

According to senior fellow and. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. The 10200 is the refund amount not the income exclusion level for single taxpayers.

The newest round of refunds has already gone out as direct deposits. By Anuradha Garg. Will I receive a 10200 refund.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went. Choose a tax professional.

Tax Preparation Checklist Tax Prep Income Tax Preparation Tax Preparation. Updated March 23 2022 A1. Thats the same data the IRS released on November 1 when it.

The latest update on IRS unemployment refund checks With the latest batch of payments the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion. 25082021 - 1225. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000.

How to check your irs transcript for clues. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Most recently the IRS issued a batch of refunds for taxes on unemployment income to almost 4 million.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. MILLIONS of Americans are wondering when they will get their tax refunds as the Internal Revenue. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

By Anuradha Garg. 2 This Notice is an update to the Notice published April 1 2021 and provides guidance to. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

As well as break down to you what you need to know in order for you to claim your unemployment tax refund based on recent updates from the IRS. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The IRS plans to send another tranche by the end of the year.

100 free federal filing for everyone. IR-2021-159 July 28 2021. If you got to this page from a PDF document we are still in the process of updating link references within our PDF documents.

Checks are coming to these States. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. 4th Stimulus Check Update.

T he IRS is continuing with its post COVID-19 initiatives and the unemployment refunds are set to arrive for the. Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. Irs unemployment tax refund update today Sunday March 13 2022 Edit.

Discover short videos related to unemployment tax refund update today on TikTok. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. To date the IRS has identified over 16 million eligible taxpayers and issued over 117 million unemployment tax refunds totaling 144 billion. The News Girl lisaremillard AJ training and consultingnicholefeather1 Tax Professional EA dukelovestaxes The News Girl lisaremillard taxladytishtaxladytish Mr Nelzoncredittaxstrategisnelz Virtual Tax.

The refunds are for people who collected unemployment last year and filed their 2020 returns before mid-March. A quick update on irs unemployment tax refunds today. What to know.

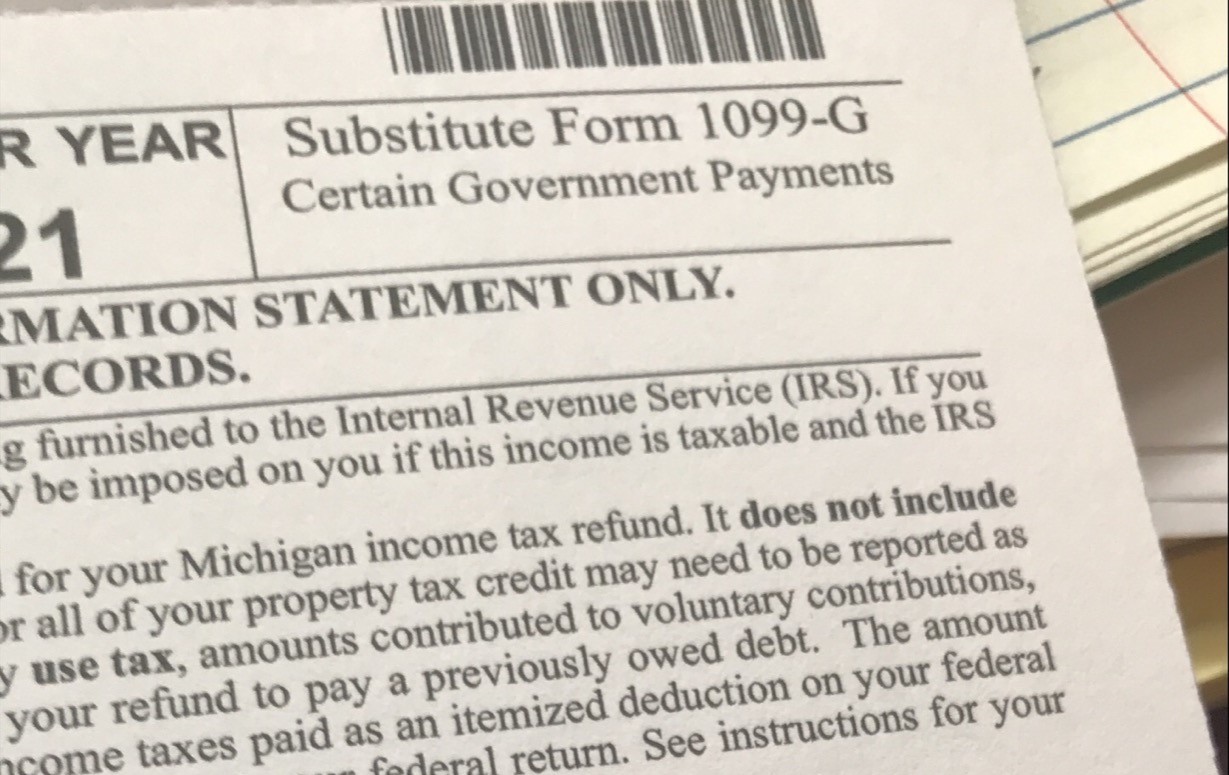

This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. The unemployment refunds were first announced in March and are the result of changes to the tax law authorized by the American Rescue Plan Act which excluded up to 10200 in taxable income from. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Monday May 16 2022. Please update any bookmarks that you previously saved. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

A quick update on irs unemployment tax refunds today. The status of collections activities on alleged overpayments of unemployment insurance is unclear once again as the Michigan Unemployment Insurance Agency has urged a judge to clarify. Unemployment tax refund today.

Premium federal filing is 100 free with no upgrades for premium taxes. Although the IRS began processing unemployment tax refunds in May it started with the most basic tax returns and processing the remaining tax returns. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

The IRS has identified 16. Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

The new brackets and rates would be effective for the 2021 tax year. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Thousands of taxpayers may still be waiting for a.

In a blog post on Wednesday Erin M. Each respective proposal includes the same three new tax rates985 percent 1085 percent and 1185 percentbut imposes such rates at differing income thresholds.

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Self Employed Tax Preparation Printables Instant Download Etsy Tax Preparation Tax Checklist Tax Prep

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Tax Preparation Tax Prep Checklist

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Shocking Turn Of Events Fourth Stimulus Check Update Unemployment Up Shocking News The Daily Show Breaking News

Refund Of State Unemployment Tax

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Tax Preparation Checklist Tax Prep Tax Preparation Income Tax Preparation

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest